Jeddah is a key economic and commercial hub in Saudi Arabia, significantly supporting the country’s sustainability transformation. With increasing regulatory requirements, corporate sustainability initiatives, and investor demand for ESG (Environmental, Social, and Governance) compliance, businesses in Jeddah must integrate sustainable strategies, carbon reduction plans, and green finance initiatives to stay competitive.

At Clenergize Consultants, we specialize in ESG strategy development, sustainability reporting, carbon accounting, and energy efficiency consulting. Our team helps businesses in Jeddah comply with Tadawul ESG disclosure requirements, Saudi Green Initiative mandates, and global sustainability reporting frameworks while optimizing operational sustainability.

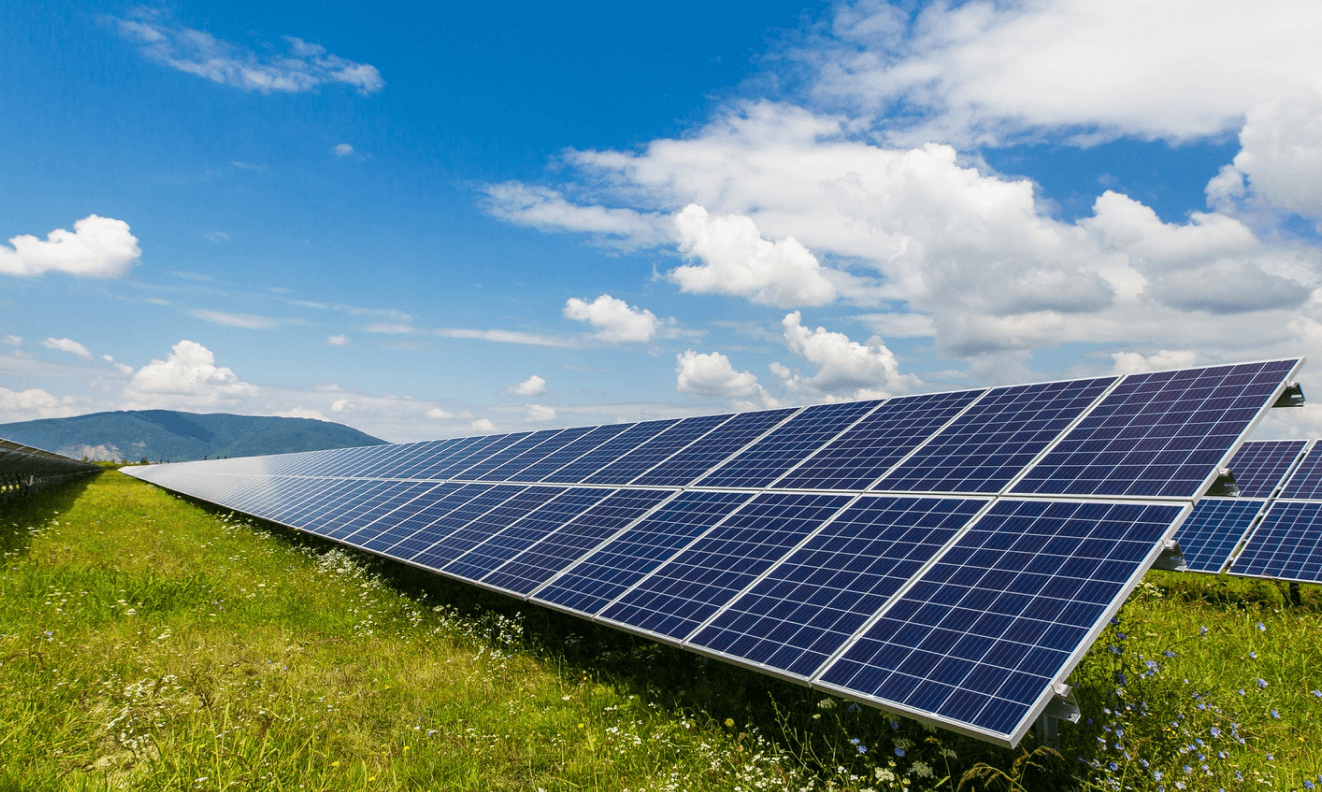

As part of Saudi Vision 2030 and the Saudi Green Initiative, Jeddah is witnessing rapid development in renewable energy, waste management, air quality improvement, and corporate sustainability. Some key factors driving ESG adoption include:

At Clenergize, we help businesses navigate the complex ESG landscape in Saudi Arabia by offering expert consulting services:

Extensive expertise in ESG frameworks, sustainability reporting, and regulatory compliance

Proven track record in assisting businesses with Tadawul ESG disclosures and Saudi Green Initiative compliance

Comprehensive consulting approach integrating ESG strategy, risk management, and financial sustainability

Customized sustainability solutions for businesses across industries

Contact Clenergize today to integrate ESG best practices into your business strategy in Jeddah!

SB 253, also known as the Climate Corporate Data Accountability Act, requires companies with annual revenues over $1 billion doing business in California to disclose their Scope 1, Scope 2, and Scope 3 greenhouse gas (GHG) emissions. Reporting begins in 2026 for Scope 1 and 2 emissions (covering the 2025 fiscal year) and in 2027 for Scope 3 emissions.

SB 261 requires companies with annual revenues over $500 million operating in California to disclose climate-related financial risks and their mitigation strategies. The disclosures, starting in 2026, must align with the Task Force on Climate-Related Financial Disclosures (TCFD) framework.

Scope 1: Direct emissions from owned or controlled sources (e.g., on-site fuel combustion). Scope 2: Indirect emissions from the purchase of electricity, steam, heat, or cooling.Scope 3: All other indirect emissions in a company’s value chain, including supply chain emissions, transportation, and product lifecycle emissions.

Non-compliance will result in penalties from the California Air Resources Board (CARB). SB 253: Fines up to $500,000 per reporting year. SB 261: Fines up to $50,000 per reporting year. Additionally, companies risk reputational damage and potential loss of investor confidence.

Clenergize Consultants provides: